Empower Your Career with Tally Certification

Learn in-demand skills in Computerised Accounting, Finance, Administration, and discover new career opportunities.

Time-Saving

Our structured courses help you learn Tally efficiently, reducing the time needed to master essential accounting skills.

Cost-Effective

Get industry-recognized Tally certification at an affordable price, ensuring maximum value for your investment.

Tally Institute Of Learning

Unique Computers Authorised by Tally Education Pvt. Ltd., Bangalore and it is a group company of Tally Solutions Pvt. Ltd., is the only entity authorized to issue certifications on Tally Course. It has been incorporated with a vision to enable small and medium organizations to manage their manpower requirements by offering simple and easy solutions to find suitable Tally skilled resources for their businesses.

5-Star Tally Certified Partner

We cater to your complex or unique business requirements. By specialized skills, we mean building solutions (over and above the default Tally product) that are tailor-made as per your business segment and operations. We effectively understand your requirements, build and deliver the right-fit solution for your business.

Our Company In Number

Years Experience

Candidates

Partners

Tally Certifications

The various levels of Course

TDS using Tally

This is a specialised certification course for learners to enhance their knowledge on theory and practise of TDS.

GST using TallyPrime

This is a specialised certification course for learners to enhance their knowledge on theory and practise of GST.

TallyProfessional

TallyProfessional certifies individuals to possess a deeper comprehension of sophisticated accounting techniques.

TallyEssential

This entry-level certification helps the learners to be proficient with computerised accounting and Tally.

Complete Guide to Inventory Management

Inventory Management course provides a comprehensive understanding of effective inventory control using TallyPrime software which is simple and flexible.

Complete Guide to Payroll & Income Tax

Payroll & Income Tax course provides in-depth understanding of payroll and tax management using TallyPrime software which is simple and flexible.

Explore Our Tally Products

The various types of products

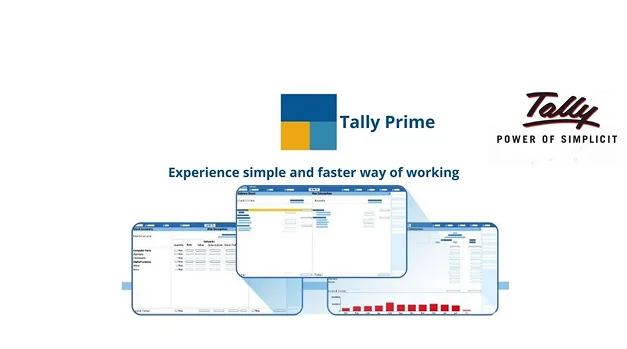

Tally Prime

Best Business Management Software Take a Free Trial Buy Software Your growth Partner To grow your business, and to make

Tally Software Services

Powerful Upgrades and Connected Services for your growing Business What is TSS? Tally Software Services (TSS) is a software subscription

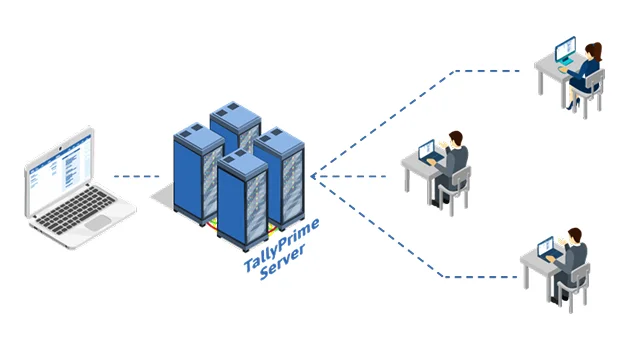

TallyPrime Server

TallyPrime Server Unleash the power of TallyPrime with a Client-Server Architecture TallyPrime Server offers powerful data server capabilities over the

TallyPrime Powered by AWS

TallyPrime Powered by AWS, Starting at 600 INR 24*7 Cloud Access, Unlimited Usage Reliable Secure Simple Affordable Get a Callback

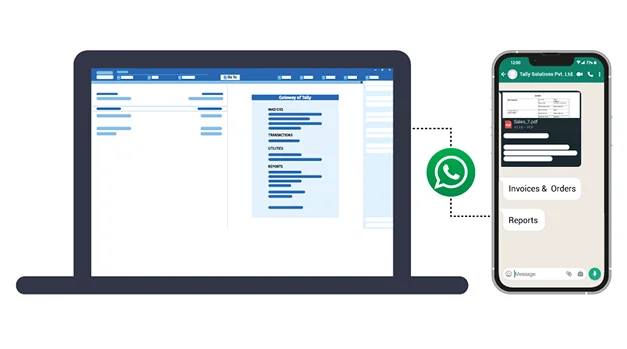

TallyPrime with WhatsApp

with WhatsApp Integrate WhatsApp with TallyPrime, starting at just ₹1300/year Get a Callback Contact your Tally Partner to get started

Extensions & Custom Solutions

Do More with Tally Tally is designed to meet your specific business requirements through a host of extensions and integrations,

Our Gallery

Our gallery showcases the journey of our students as they engage in expert-led training, gain hands-on experience, achieve their Tally certifications, and step confidently into successful careers in accounting and finance.

Testimonials

Our students’ success stories and experiences reflect the quality of education, hands-on learning, and career support we provide. Read what our learners have to say about their journey with us and how Unique Arena has helped them achieve their professional goals.

"Unique provided me with the best Tally training, helping me gain practical skills certification. The expert guidance and hands-on learning experience truly prepared me for my career."

"The faculty at Unique Arena is highly knowledgeable and supportive. Their structured training programs made learning Tally easy and the placement assistance helped me secure a great job."

"Enrolling at Unique Arena was the best decision for my career. The interactive sessions, real-world case studies, and expert mentorship gave me the confidence to excel in accounting and finance."

Our Placement

At Unique Arena, we go beyond education by providing our students with excellent placement opportunities in top companies. Our dedicated placement support ensures that every learner is job-ready with the right skills and confidence to excel in the industry. With our strong industry connections and expert training, we help students turn their learning into successful careers. Explore the success stories of our placed candidates and take the next step toward your dream job!

Start Your Journey to Success Today!

At Unique Arena, we provide expert-led Tally training, industry-recognized certification, and career-focused learning to help you excel in the world of accounting and finance. Join us to gain practical knowledge, hands-on experience, and access to top placement opportunities.